|

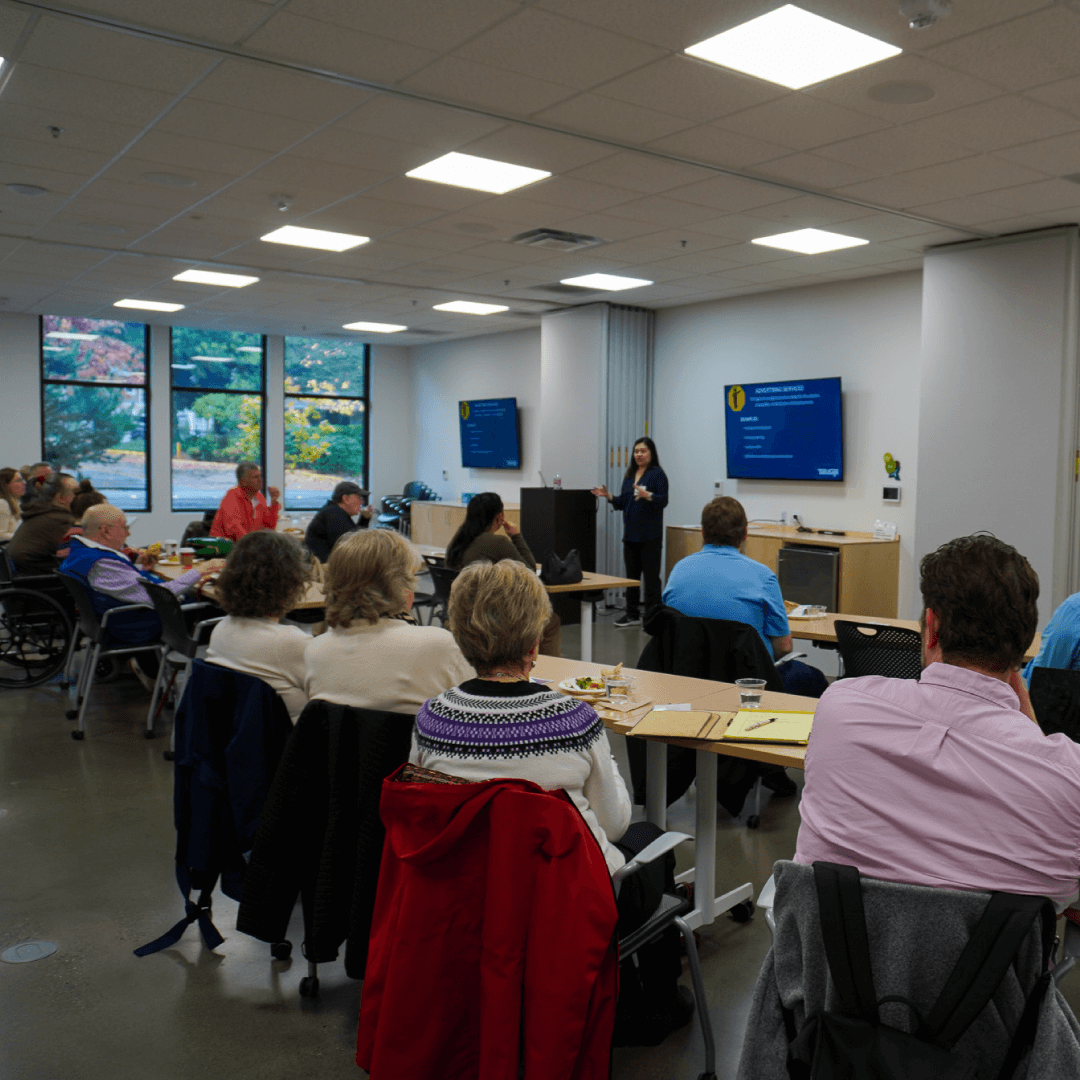

On November 6th, Lily Tran, EA, author and founder of TaxUSign®, led an informative session unpacking Washington’s newly expanded sales tax rules—now affecting a wide range of service-based businesses.

Attendees learned what’s now taxable under ESSB 5814, how to determine the correct tax rate, and key compliance practices to avoid future penalties.

Five key takeaways from the session:

- Know what’s taxable: Live presentations, advertising, IT services, website development, investigation/security, temporary staffing, and software customization are now subject to sales tax.

- Review contracts: Agreements signed or altered after October 1, 2025, may be newly taxable.

- Track locations: Tax rates are destination-based—record where services are received, not performed.

- Stay compliant: Maintain accurate records, separate sales tax on invoices, and file on time via the MyDOR portal.

- Use available tools: Visit dor.wa.gov/5814 for webinars, tax rate tools, and reporting guidance.

|